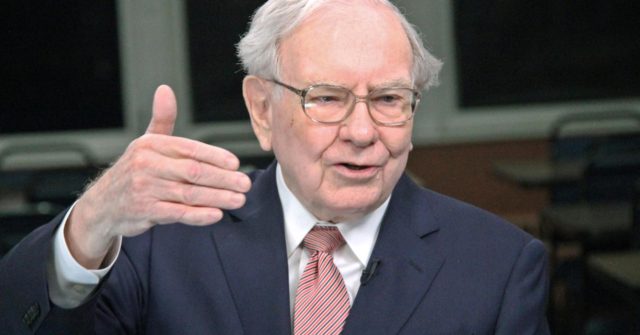

In today’s news with money stocks the world’s most successful investor according to Yahoo finance, owns $1.5 billion of each well known stock. But according to Warren Buffet in 2012, investing in apple stocks was not on his to do list, because he claimed that he didn’t want to invest in fast growing techs. But in life things change, people change, their minds specifically. Do you think Buffett would change his way of viewing apple stocks?

According to Buffett Apple is not a fast growing tech anymore as it used to be. Apple is set to grow 8.7% yearly, comparative to the 30% growth from the past five years. Another reason Buffett has invested in Apple is because; it is an old-fashioned value stock. To put it in perspective for you, despite the fact that shareholders are commonly agreeable to pay up to buy fast-growing tech names, for example Forbes: that’s not exactly been the situation for Apple.

Seemingly, the stock trades at price/earnings relation (based on projected earnings over the next 12 months) of about 12. By contrast, the P/E ratio for the wide stock market is approximately 19. This means that Apple is significantly cheaper and attracts guys like Buffett. And in other words, Apple is a cheaper replacement and alternative.

Another reason is that Buffett’s attention in Apple is “a recognized company of the omnipresent authority of technology all over the business and user world.” To put things in perspective and to go analogical on you, I’m going to set an analogy for you.

Apple’s business model is comparable with Gillette’s razor-and-blade method, where buying the basic razor compels you the consumer to buy continuous blades. Apple’s app, iTunes is the razor in this picture. After continuously buying music on iTunes, media users are locked in with apple products. It is efficient and easy to use. Hence, when new iPhones that come out every year, people continue to upgrade considering the decrease from the 3-year plans to 2.

Lastly, Buffett has always been comfortable with investing when the market has not been steady. I think that’s the risk you take when you become an investor. He quotes, “the key to successful investing is being fearful when others are greedy and greedy when others are fearful.” (Buffett, Yahoo, Finance) Investors like George Soros have been fearful of hanging onto apple, considering the decrease in growth.

So we can understand why Buffett was so inclined to not purchase Apple at the beginning. Even though stats don’t lie, I still find Apple to be a very successful company, and I believe that more people have switched over from Android to Apple. Apple is still one of the leading competitors in terms of purchasing music and with cellular devices. I bet if you were to conduct a survey of what types of phones people have, I guarantee Apple would be number one. Maybe you want to prove me wrong and test it out.